Which is Right for You?

Which is Right for You?

2020 drastically changed the remote-work condition for employers. With advancements in technology, working remotely can be equally or more effective then working in a traditional office setting for many businesses.

For example, talent acquisition sourcing and recruitment tasks are often executed from remote-work spaces, with 60-70% of the work performed via telephone or online.

Insourcing Recruitment

When you should consider hiring an employee for an in-house for Talent Acquisition position:

- – The work to be performed must be done under your direct supervision.

- – The employer needs to direct and manage the work completed, including the tools and equipment used by the employees.

- – A significant portion of your hires require onsite, in-person recruiting, including career fairs.

Outsourcing Recruitment

When you should consider contracting Top Source Talent for your Talent Acquisition needs:

- – For immediate hiring ramp support completed by a professional with resources that work well independently.

- – Immediate results, without the need for oversite.

- – The Top Source Talent team uses tools that reduce time-to-fill for client companies, providing faster-ramp candidate pipelines.

- – Top Source Talent provides client companies with both full-cycle and sourcing services. The Top Source Talent team possesses decades of experience and expert client and candidate relationship skills that extend beyond the internet.

- – Strategies & Insight. The Top Source Talent uses cutting-edge technologies and tools for talent acquisition sourcing and recruitment.

- – Top Source Talent will scale services and resources up/down as your hiring needs increase or decrease.

- – While hiring is an important role in any company, generally the process of finding qualified talent isn’t your core business. Hiring Top Source Talent allows clients to focus on other aspects of their businesses.

- – Financial Savings. Top Source Talent provides significantly reduced fees* allowing clients to reinvest in their companies and employees.

What is the Difference?

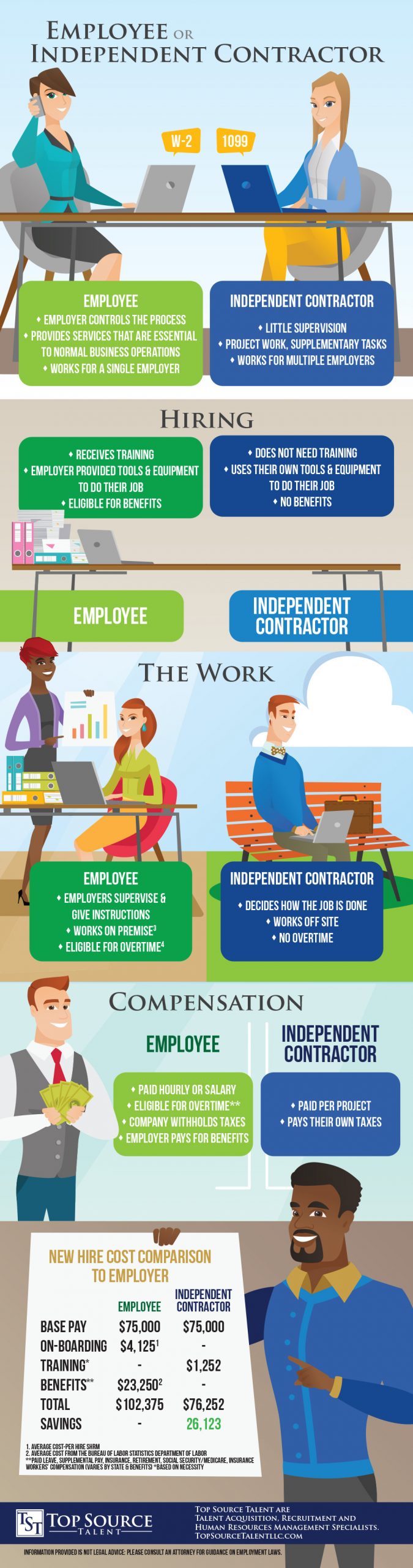

An employee is a person who works in the service of another person under an express or implied contract of hire, under which the employer has the right to control the details of work performance (Black’s Law Dictionary).

PROS:

Team-building — Bringing on a full-time employee can be a vital step toward building stronger, more synchronized teams. Plus, you can provide more direction in-line with your business goals.

Familiarity with the business — In time, an employee will get to know the business, the company culture, and the expectations of his/her management team; as well as internal processes. All of these qualities can help ensure your company runs more smoothly and efficiently.

CONS:

Investment in staffing — Working with employees is a financial and time investment. In addition to paying for salary, insurance and equipment, you’ll assume the costs for mentoring, training and managing the employee.

A poor hiring fit — When you make a less-than-desirable hire, you must deal with the drain on your business resources, including the time and effort it takes to terminate a poor hire; and the time/cost of identifying a better-qualified replacement. If an independent contractor doesn’t work out, you can choose not to work with them again.

An independent contractor is a company that enters into a specific client service contract and designates a project contractor for an fixed fee. The appointed contractor works within a specified Statement of Word (SOW), providing services or goods for the time period specified in the client service contract.

PROS:

Greater flexibility — Flexibility is a key advantage of using independent contractors. You can request and receive the exact services needed, when you need them. For example, if you’re seeking someone to build a website or create brochures for prospects, but you won’t need their skills on a permanent basis, it makes sense to hire a web developer or marketing consultant on a per-project basis.

More affordable — Although you may pay more per hour for an independent contractor, your overall costs are likely to be less. You don’t have pay withholding and unemployment tax, or workers comp insurance. As the employer, you don’t need to provide healthcare benefits or cover the cost of office space or equipment.

CONS:

Reduced control — It’s right in the name — independent You can set deadlines for deliverables and provide project guidelines to these workers, but you can’t oversee their day-to-day activity or dictate how they get the work done. Contractors are expected to work autonomously, and generally able to establish their own work schedules.

Less company loyalty — Most independent contractors work with multiple clients, so you can’t assume they will prioritize your projects (although you can build certain expectations into your contract). And with each new contractor you engage there will likely be a learning curve.

An employee is a person who works in the service of another person under an express or implied contract of hire, under which the employer has the right to control the details of work performance (Black’s Law Dictionary).

PROS:

Team-building — Bringing on a full-time employee can be a vital step toward building stronger, more synchronized teams. Plus, you can provide more direction in-line with your business goals.

Familiarity with the business — In time, an employee will get to know the business, the company culture, and the expectations of his/her management team; as well as internal processes. All of these qualities can help ensure your company runs more smoothly and efficiently.

CONS:

Investment in staffing — Working with employees is a financial and time investment. In addition to paying for salary, insurance and equipment, you’ll assume the costs for mentoring, training and managing the employee.

A poor hiring fit — When you make a less-than-desirable hire, you must deal with the drain on your business resources, including the time and effort it takes to terminate a poor hire; and the time/cost of identifying a better-qualified replacement. If an independent contractor doesn’t work out, you can choose not to work with them again.

An independent contractor is a company that enters into a specific client service contract and designates a project contractor for an fixed fee. The appointed contractor works within a specified Statement of Word (SOW), providing services or goods for the time period specified in the client service contract.

PROS:

Greater flexibility — Flexibility is a key advantage of using independent contractors. You can request and receive the exact services needed, when you need them. For example, if you’re seeking someone to build a website or create brochures for prospects, but you won’t need their skills on a permanent basis, it makes sense to hire a web developer or marketing consultant on a per-project basis.

More affordable — Although you may pay more per hour for an independent contractor, your overall costs are likely to be less. You don’t have pay withholding and unemployment tax, or workers comp insurance. As the employer, you don’t need to provide healthcare benefits or cover the cost of office space or equipment.

CONS:

Reduced control — It’s right in the name — independent You can set deadlines for deliverables and provide project guidelines to these workers, but you can’t oversee their day-to-day activity or dictate how they get the work done. Contractors are expected to work autonomously, and generally able to establish their own work schedules.

Less company loyalty — Most independent contractors work with multiple clients, so you can’t assume they will prioritize your projects (although you can build certain expectations into your contract). And with each new contractor you engage there will likely be a learning curve.

Hiring Employees

When you hire an employee, you have the advantage of being able to assign and direct the employee’s work during his/her work schedule hours. As an employer, it is your responsibility to train your employee to work within the expectations of the position he/she is hired for; and to require the employee to work exclusively for your company if he/she is hired for a full-time position.

If you and your employee reside in a “right to work state”, you are generally able to terminate an employee without advanced notice or payment beyond his/her last day of work. If a severance pay agreement is part of the employment contract between employer and employee, then the company must comply with the severance employment contract.

Hiring employees presents employers with numerous employment laws and regulations. Both the federal government and the employer’s state regulate wages and salaries, including overtime, vacations and personal paid-time-off, and benefits.

An employer is also responsible for timely payroll tax payments to the IRS and state revenue departments; including employer-matching FICA taxes (Social Security and Medicare) for each employee. Other employer financial responsibilities include state unemployment and worker’s compensation insurance.

Hiring Independent Contractors

Hiring Independent Contractors for companies and corporations has more limited financial responsibilities.

A contractor working within a client SOW must work within the contract perimeters, including payment requirements for the contracting company. An independent contractor works to complete all contract responsibilities by the SOW imposed deadline.

The contracting company must allow the contractor to work without guidance or supervision in order to carry out his/her contract responsibilities. An independent contractor is able to contract for multiple companies in parallel; and is often able to schedule his/her own work hours and provide his/her own tools.

A contracting company does has limited tax responsibilities for independent contractors. The contracting compay must require a completed and signed IRS Form 1099-MISC (aka 1099) from all qualified independent contractors, but is not responsible for paying the federal or state taxes for 1099 contractor workers. Employers are able to provide some benefits to contract workers (ie. personal time off or limited health benefits), but these benefits are not required.

Payroll and financial responsibilities for an employer hiring contract workers are significantly less than hiring full-time employees.

Experience the Difference

The benefits of contracting with Top Source Talent for your talent acquisition recruitment and hiring needs frequently surpass the tactical requirements of hiring regular full-time employees.

The decision to hire an employee or contractor is ultimately determined by the objectives of your company.

Reach out to us today, contact us at directly at 970-562-4891.